Birth, marriage and death are considered very important events in Chinese culture. Birth and marriage are accompanied with happy celebrations, but death is something that is seen as inauspicious and a taboo subject.

Nevertheless, the concept of filial piety is strong in China and no expenses are spared in conducting a proper funeral and burial for the deceased. Incidentally, there is also a three day national holiday every year for Qingming festival, when people visit their ancestors’ graves to give offerings and pay their respects.

After a person’s death, a funeral is usually conducted in accordance to their beliefs, culture, religion and traditions. Subsequently, as mandated by law in most urban areas, the body is cremated. In rural areas, burials of non-cremated bodies are mostly allowed.

Cremation is encouraged by the government because of the sheer size of the population. Cremation is performed only by government entities with strict control on pricing. After cremation, the cremains are buried in a burial plot in a cemetery or stored in a columbarium.

Business

Fu Shou Yuan (1448.HK) is a provider of burial and funeral services in China, with operations in more than 10 cities. It reported profits of RMB 550m on revenues of RMB 1.47b in 2017. 88.0% of total revenues came from burial services and 10.7% came from funeral services, with the rest coming from auxillary services.

Since burial services comprise the overwhelming majority of revenue, I will only focus on analysis of burial services. It comprises of revenue generated from selling burial plots in cemeteries operated by FSY. Selling burial plots is a localized business as people typically do not go to cemeteries in other towns or cities to bury their loved ones. According to Fu Shou Yuan (FSY), their cemeteries and funeral facilities generally serve customers who live within a 1 to 1.5hr radius.

The number of customers that death care services providers are able to attract is largely a function of reputation, quality of service and well-maintained and conveniently located facilities, although other factors such as competitive pricing are also important factors.

Due to the importance of reputation, quality of service and well-maintained and conveniently located facilities, new or smaller less well-known death care services providers will generally take a long period of time to increase their customer base.

Families tend to return to the same cemetery for multiple generations due to family ties and convenience of future visits. As the largest death care service provider in Shanghai, where FSY derives more than 50% of their total revenues from, this is a big competitive advantage.

However, I believe that the reputation advantage does not extend geographically because of the localized nature of the business and low frequency of purchase in a customer’s lifetime. In other words, if FSY operates a new cemetery in a new city, it may also be difficult to attract new customers due to entrenched competitors with better local reputation. Furthermore, of the 14 cemeteries operated by FSY, only 5 is operated under the FSY brand.

FSY “owns” plots of land, usually of around 100,000 sqm or more. Such land requires government land zoning approval to be used as a cemetery. The land is then gradually developed over time, designed by landscape architects into aesthetically pleasing cemeteries to house burial plots.

In China, all land are owned by the state or the local government. Hence, when anyone buys land, they are actually buying the “land use right” for a fixed number of years, after which the rights have to be renewed for a fee, or the land has to be returned.

There is, however, an exception. Some land, such as portions of FSY’s Shanghai’s land parcels, are considered “allocated land”. Such land do not have a definitive term or payment of land premium. This is highly valuable, especially in Shanghai where burial service prices are high as FSY enjoys the increase in land prices over time without having to fork out any additional land premium. But, if there are changes in the laws governing allocated land, FSY may be forced to return the land or fork out a land premium at the prevailing market rate.

The service provided by FSY in signing a contract with a customer is the safekeeping of the cremains for a specified amount of time (ranging from 20-70 years) , and does not involve a transfer of the land use rights to the customer. The contract price also includes a portion for cemetery maintenance fees. The time specified in the contract may sometimes be longer than the land use right of the land. Though it is unlikely, in future cases where FSY is unable to extend the land use right, they may be legally required to compensate customers for not being able to use the burial plot for the remaining term in the contract. At the end of the contract, the customer may renew it at the prevailing market rate or retrieve the cremains, otherwise FSY may handle the cremains at its own discretion.

The table below shows the number of burial plots sold, land expended, and land bank held by FSY. Here, like land expended, land bank is defined as the total estimated saleable area designated to burial plots only, and does not include common areas like walkways and landscaping.

|

2013 |

2014 |

2015 |

2016 |

2017 |

| No of units sold |

7,667 |

10,093 |

17,322 |

13,142 |

22,663 |

| Land expended (sqm) |

17,848 |

20,690 |

40,998 |

35,644 |

33,546 |

| Land bank (sqm) |

972,664 |

1,387,724 |

1,610,000 |

1,810,000 |

1,960,000 |

The number of burial plots sold increased over time, with the exception of 2015-2016. The reason for the drop is because in 2015 there was a one time relocation of tombs paid for by the local government in Henan of about 3,500 burial plots, and 2,400 sold at very low prices for social welfare purpose. If we only count the normally priced burial plots, there was an increase of more than 10% sold in 2016. 2017’s units sold came in flat year on year, after excluding the 656 units in 2016 and 10,291 units in 2017 sold at very low prices.

Based on 2017 sales, the current land bank is enough to last for a few decades. The reason for holding so much land bank is that land zoned for cemetery use is scarce due to difficulty in getting zoning approvals. Holding land now to develop in the future benefits from increasing land prices due to limited supply against increasing demand.

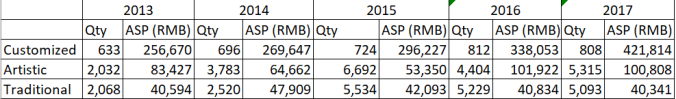

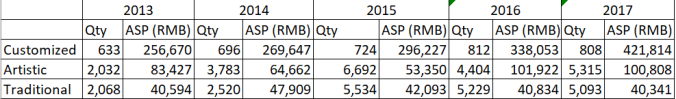

The table below shows the average selling price (ASP) and quantity of 3 types of burial services sold by FSY in the respective years. These 3 types of burials make up 80-85% of total burial service revenue.

The prices of each type of burial service differ from city to city, and price changes over the years may be due to difference in sales mix. But, one clear price trend is the increase in customized burial plot prices. Customized burial services allow for customers to fully customize their burial plots, allowing them to decide on the location, size, and design and layout of the burial plot, and the types and styles of memorials and decorative items to be used.

In my opinion, people in China generally do not shop around and haggle when it comes to the funeral and burial of their loved ones. Having a funeral and burial befitting of the social status of the deceased, and compatible with their religion, culture, beliefs and tradition is of greater importance. Consumers, especially those who are more well to do, may be quite price insensitive for death care services.

The average absolute price point of customized burials is about 6 times China’s GDP per capita, implying that this kind of service is probably only bought by very well to do customers. I think the reason for FSY’s implied pricing power in this category is due to limited supply of cemeteries, target customer price insensitivity and opaqueness of pricing due to highly customized nature of the product.

I believe that the increase in price for customized burials should continue to be realized in the future, and this is significant for FSY as such services make up between 25-30% of total burial services revenue.

However, in a recession, my personal guess is that the standardized burial services will be able to maintain their demand and pricing, whereas prices for customized burials will be adjusted downwards.

Industry

The death care industry in China is highly fragmented and highly regulated. Even though FSY is the largest player, it only has a market share of about 1%. Most of the players are government owned. Government owned entities are typically run for social welfare purposes and may not be as efficient or well managed as their privately owned, for profit counterparts.

There are several barriers to entry to the industry, which favour the largest local incumbents.

Firstly, government approval is required to set up a funeral or burial service company. This is a difficult and lengthy process which may take up to a few years.

Secondly, land for building cemeteries need to have zoning approval. This can also take up to a few years and land zoned for such purposes is limited in quantity.

Thirdly, the industry lacks experienced professionals as it is not an industry which people are likely to join due to the social stigma associated. New employees are often relatives of those already in the industry.

Growth

In my opinion, FSY’s organic growth in the future will largely be from increase in prices and units sold. Prices for burial services sold is likely to increase due to reasons mentioned before. There are about 10m deaths in China every year, with this number expected to increase due to China’s ageing population. With the urbanisation rate set to increase as the country develops further, the demand for FSY’s services will increase as mandated by laws in cities for compulsory cremation.

Also, FSY started selling their self-developed eco-friendly cremation machines in 2017 and expects this to be a major contributor to revenues in the future. According to them, this is currently the only locally produced cremation machine that is able to meet the stricter emission standards that the government is rolling out over the years.

Another source of growth is through acquisitions. The market is highly fragmented and dominated with state players, with FSY being the largest player. Hence, it is unlikely that any single acquisition of a private operator will add significant value. However, the RMB 441m spent on acquisitions from 2013-2016 has been value accretive. This is because competitors were typically bought out at around 1.5x book whereas FSY enjoys a valuation of 3-4x book.

Lastly, while the brand equity of FSY as a national brand is not as strong to consumers unlike other consumer brands, its positive reputation among industry players is quite important. This is because the government is looking to deregulate the industry over time and may allow private operators to take up a greater share of the death care industry or form partnerships with them in carrying out services. FSY, which has one of the strongest reputation in the industry, is likely to be more favored by the government.

FSY has three ongoing partnerships with local governments, namely in Jiangsu Dafeng, Shandong Taian, and Chongqing Bishan. All partnerships are based on the build, operate, transfer model, whereby FSY is responsible for building and management of funeral parlours and cemeteries for 35-50 years. Profits accrue to FSY during this period and at the end of the term, the operations are transferred to the local government at no cost.

Capital Allocation

FSY spent a total of RMB 441m in acquisitions since 2013. The two most significant were a 70% interest in Guanglingshan Cultural Cemetery (GCC) for a consideration of RMB 279m and a 80% interest in Changzhou Qifengshan Cemetery (CQC) for a consideration of RMB 184m. GCC contributed RMB 141m and CQC contributed RMB 30m in revenues in 2016.

Around a third of earnings are paid as dividends. This is reasonable but FSY can afford to pay more. There is RMB 1.5b in cash and time deposits against RMB 100m in borrowings. Unless FSY spends a lot more on acquisitions, the free cash flow generated every year will build up the existing cash level quickly.

Valuation

In summary, I think FSY has a very strong competitive position with a long runway for growth from acquisitions and pricing power.

With RMB 417m in profits attributable to shareholders and share price of HKD 7.14, this represents a P/E ratio of around 31. In my opinion, the current price represents fair value at best compared to what other companies with similar competitive characteristics are selling for at the moment.

If FSY is able to continue its strong earnings growth in the future, you will still do well by entering at today’s levels. I prefer to be more conservative and wait for a better valuation, keeping in mind that the intrinsic value of the underlying business is quite likely to grow at a decent rate in the future.

There is also one caveat of taking FSY’s earnings at face value, which I will discuss below.

A typical property developer has “lumpy” earnings, because its earnings from the development of a project are “one-off” in nature. If it does not acquire more land for future development, it will not report any earnings. As such, valuing a property developer based on a multiple of earnings may not accurately reflect the value of the business.

FSY’s business is similar to a property developer in that it obtains land, develops and “sells” it to customers. But, the difference is that there is continuity in FSY’s earnings because it is able to earn revenues for the same plot of land indefinitely. Effectively, the customer signs a fixed term contract to “buy” some space on the land, and has to pay to renew at the end of the term. If they choose not to renew, FSY can reuse and “sell” the space to a new customer. Here, I am assuming that the land use right obtained by FSY is renewable indefinitely, albeit at a price.

Once a burial plot is constructed and delivered to a customer, the full amount is recorded as revenue. On the other hand, revenue from the provision of cemetery maintenance services, is deferred and amortized on a straight-line basis over the remaining service period. The full price paid for both services are received as cash on the sale of the burial plot.

Land and initial development costs are amortized until a particular area is designated for sale of burial plots. The land and initial development costs for that particular area are moved into inventory, and expensed when the burial plots are sold after further development costs.

In my opinion, the net profit figure is a reasonable representation of the economic benefit that flows to FSY. The cash flow figure is inflated because the full amount of cemetery maintenance is collected upfront and cash payment for “land use rights” were incurred fully at the time of purchase, which could have been many years ago.

Then, is FSY’s earnings in any given year a good representation of its long term earnings power? I think the answer is not so simple. It depends on the weighted average duration of the customers’ contracts as well as the percentage of saleable area sold in that year.

Let’s consider the simple case where FSY only has one plot of land, and the weighted average duration of a new customer contract is 50 years. If FSY sells 100% of the saleable area in the first year, it will record all of the profits and receive cash upfront from the sale of burial plots in that year. From the second year onwards, FSY will be unable to sell any more burial plots as there is no space available until the customer contract is due in 50 years. It will only record cemetery maintenance revenues for the next 49 years. Such revenues are a fraction of profits recorded in the first year.

Based on the example above, it is clear that if we were to value FSY based on a multiple of its first year’s earnings, we would be vastly overestimating its earnings power. It would only be an accurate representation if the weighted average duration of a new customer contract is 1 year.

By observation, if x years is the weighted average duration of a new customer contract, earnings in any single year is a roughly accurate representation of FSY’s long term earnings power only if they sell (100/x) percent or less of total saleable area on average in any given year.

If the average area sold in a year is more than (100/x) percent of total saleable area, FSY will run out of saleable land faster than it can charge customers again for the same plot of land. Earnings in any given year will be an overestimate of its actual earnings power.

If the average area sold in a year is less than (100/x) percent of total saleable area, all of the saleable land will not be fully used up at any given time, hence ensuring a recurring source of profits indefinitely. In this case, profits in any given year will be a reasonable representation of earnings power, but FSY is not maximizing the profit potential of its land.

If the average area sold in a year is equal to (100/x) percent of total saleable area, this is the rate of sales which naturally ensures that the maximum possible amount of land is available for sale each year given that profits in each year must be roughly the same. Hence, this is the ideal case where profits are being maximised and profits in any given year is a reasonable representation of earnings power.

In all the cases above, I am making the critical assumption that the prices of burial plots do not change over time and cemetery maintenance profits are insignificant relative to profits from sale of burial plots.

To accurately calculate FSY’s earnings power, we need the following data for each cemetery:

1. Weighted average duration of existing customer contracts and total saleable land sold in the past

2. Weighted average duration of new customer contracts and average saleable land sold in a year

Unfortunately, data needed to accurately evaluate the reasonableness of earnings may not be readily available.

In Shanghai (53.5% of revenues), we know that the business started in 1994 according to the IPO prospectus. Further, the average term of each customer contract is typically 70 years (p162, IPO prospectus). Therefore the optimal rate of sale of land should be 100/70 = 1.4% annually.

On p2 of this research piece by Macquarie, saleable area in 2015 in Shanghai is 186,046 sqm out of a total area of 303,729 sqm. This implies that 117,683 sqm of area was sold from 1994-2015, at an average of 5,603 sqm per year. This is about 1.8% of the total area, which is higher than the optimal rate of sale of 1.4% annually. This may suggest that current earnings are inflated.

In conclusion, one should be mindful that any future increase in earnings due to an accelerated sale of land may not be sustainable because FSY is enjoying current earnings at the expense of future earnings. In such a case, it needs to continually depend on other sources such as acquisitions or a new product line in order to make up for the “loss” in future earnings as a result of selling land too quickly at the present.